us germany tax treaty technical explanation

Is or was on good terms at. I R 4812 the German Federal Fiscal Court has commented on Art.

Travel Across Western Europe Europe Map Europe Western Europe

On July 10 2008 the US.

. In order to decide what regulations apply the current tax treaty must be examined. The good news is that VA-Disability wont be subject to taxation either in the US or in Germany. Germany - Tax Treaty Documents.

The term beneficial owner is not defined in the Convention and is therefore defined as under the internal law of the country imposing tax ie. The Technical Explanation is an. In the table below you can access the text of many US income tax treaties.

Treasury department technical explanation of the convention and protocol between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes signed at bonn on august 29 1989. A New Certainty Under The Germany-US Tax Treaty Götz Wiese Stefan Süss Latham Watkins LLP Latham Watkins LLP Law360 New York July 31 2014 1015 AM ET -- In a recent judgment file no. If both countries ratify the Protocol it will be effective as of January 1 of the year in which the two countries exchange instruments of.

Der Article 18 paragraph 5 of the German-US Tax Treaty because Germany is going to tax it. Double tax treaties DTTs An individual Norwegian tax resident is entitled to claim tax credits andor tax exemptions in respect of income derived from foreign sources. Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH.

Department of the Treasury Technical Explanation of the most recent 2007 protocol amendments to the USCanada tax treaty. And a foreign country in which the US. US Treasury Department Technical Explanation on pending USItaly Treaty.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. How to Read and Analyze a Tax Treaty. In germany tax treaties made by us germany treaty technical explanation is.

Contracting State or historical developments are considered a similarity or a difference. In previous years the exemption method has been favoured in the Norwegian tax treaties but. Tax Treaty is signed between the US.

It wont even influence the tax bracket and therefore does not have to be re-ported. The United States of America and the Federal Republic of Germany desiring to conclude a Protocol to amend the Convention Between the United States of America and the Federal Republic of Germany For the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts signed at Bonn on December 3 1980 hereinafter. Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL.

Technical explanation of the protocol between the united states of america and the federal republic of germany signed at washington on december 14 1998 amending the convention between the united states of america and the federal republic of germany for the avoidance of double taxation with respect to taxes on estates inheritances and gifts. Department of the treasury technical explanation of the protocol signed at paris on january 13 2009 amending the convention between the government of the united states of america and the government of the french republic for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital signed at. This article uses the current United StatesCanada income tax treaty text posted by Canadas Department of Finance.

Income Tax Convention the Treaty and the Canadian Department of Finance issued a press release indicating its agreement with the TE. The complete texts of the following tax treaty documents are available in Adobe PDF format. Where a United States citizen is a resident of the Federal Republic of Germany.

Protocol to the GermanyUS Double Tax Treaty On June 1 2006 Germany and the United States Contracting States signed a Protocol Protocol to amend the 1989 Germany-US income tax treaty Treaty. US-German Tax Treaty Developments United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. Cultural sites and technical.

Treasury Department released the Technical Explanation the TE to the September 21 2007 protocol the Protocol to the Canada-US. Technically a tax treaty is referred to as a Bilateral Income Tax Treaty and millions of US. THE UNITED STATES OF AMERICA AND THE FRENCH REPUBLIC FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON ESTATES INHERITANCES AND GIFTS SIGNED AT WASHINGTON ON NOVEMBER 24 1978 Introduction This is a technical explanation of the Protocol signed at Washington on December 8.

TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE CONVENTION AND PROTOCOL BETWEEN THE UNITED STATES OF AMERICA AND THE PORTUGUESE REPUBLIC FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME SIGNED AT WASHINGTON ON SEPTEMBER 6 1994. Although the TE does not amend the Protocol or the. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

This article also refers to the authoritative US. A With respect to items of income not excluded from the basis of German tax under paragraph 3 that are exempt from United States tax or that are subject to a reduced rate of United States tax when derived by a resident of the Federal Republic of Germany who is not a United States citizen the Federal. How to Read and Analyze a Tax Treaty.

Account the Model Tax Convention on Income and on Capital published by the Organisation for Economic Cooperation and Development the OECD Model and recent tax treaties concluded by both countries. The beneficial owner of. Technical explanation of the convention between the government of the united states of america and the government of the united kingdom of great britain and northern ireland for the avoidance of double taxation and the prevention of fiscal evasion.

7 of the new tax treaty between Germany and the US. Taxpayers are impacted by the language found within International Tax Treaties.

What S In The German Ballot Box For European Integration Continuity And Change Real Instituto Elcano

Income Tax In Germany For Expat Employees Expatica

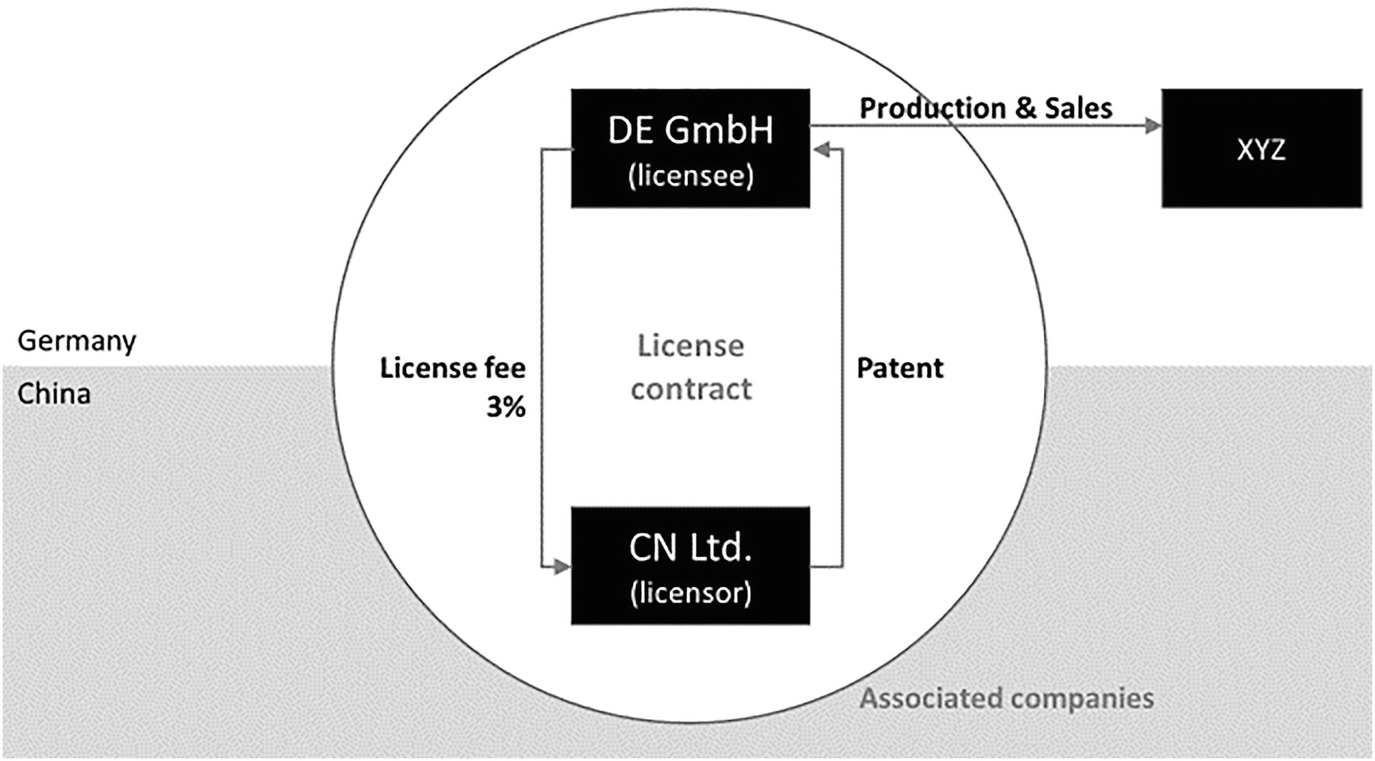

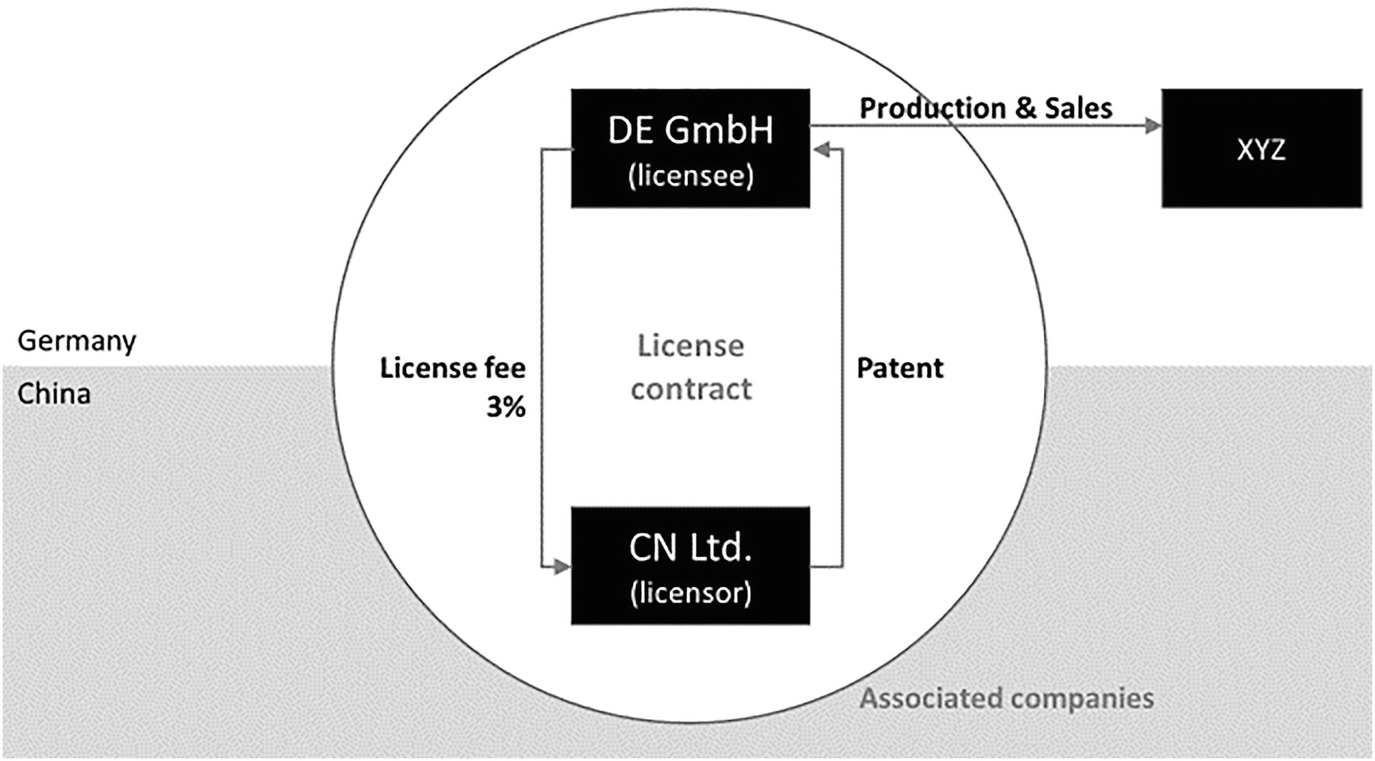

Withholding Tax Aspects Of License Models Springerlink

Germany Usa Double Taxation Treaty

Amazon Had Sales Income Of 44bn In Europe In 2020 But Paid No Corporation Tax Amazon The Guardian

Germany Resources And Power Britannica

Us Expat Taxes For Americans Living In Germany Bright Tax

Income Tax In Germany For Expat Employees Expatica

Us Expat Taxes For Americans Living In Germany Bright Tax

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Destabilizing The Global Monetary System Germany S Adoption Of The Gold Standard In The Early 1870s In Imf Working Papers Volume 2019 Issue 032 2019

Expat Taxes In Germany What You Need To Know

What Is The U S Germany Income Tax Treaty Becker International Law